nebraska sales tax rate on vehicles

Groceries are exempt from the Nebraska sales tax. You must pay sales tax when you lease.

How To File And Pay Sales Tax In Nebraska Taxvalet

Vehicles are considered by the IRS as a good that can be purchased sold and traded.

. Counties and cities can charge an. Printable PDF Nebraska Sales Tax Datasheet. Nebraska has recent rate changes Thu Jul 01 2021.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska state sales and use tax rate is 55 055. Do I have to pay sales tax on a used car in Nebraska.

Have your vehicle inspected at a certified inspection station. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. The Nebraska state sales and use tax rate is 55 055.

With local taxes the total sales tax rate is between 5500 and 8000. The state sales tax rate in Nebraska is 5500. The Nebraska state sales and use tax rate is 55 055.

The Nebraska sales tax on cars is 5. The sales tax on a car purchased in Nebraska is 55 statewide. Registration Fees and Taxes.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Driver and Vehicle Records.

The sales tax on a used vehicle in Nebraska is 55 the same. While some counties forgo additional costs most will charge a local tax on top of the state. Like all other goods retailers are required to.

There are several steps to register your vehicle with the Texas Department of Motor Vehicles. How Does Sales Tax Apply to Vehicle Sales. NE Sales Tax Calculator.

The statewide sales tax for Nebraska is 55 for any new or used car purchases.

Taxes And Spending In Nebraska

What State Has No Sales Tax On Rvs Rvshare

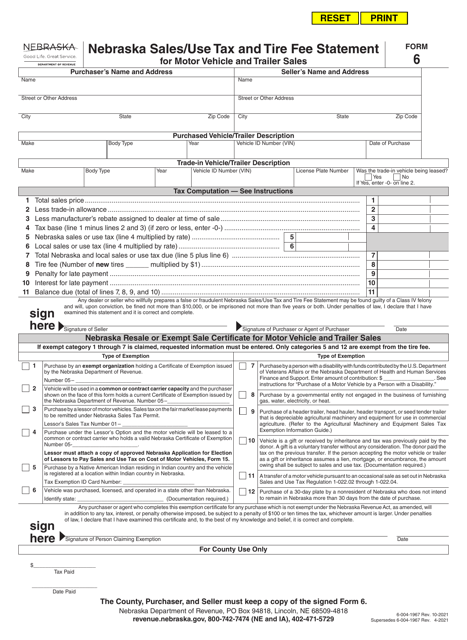

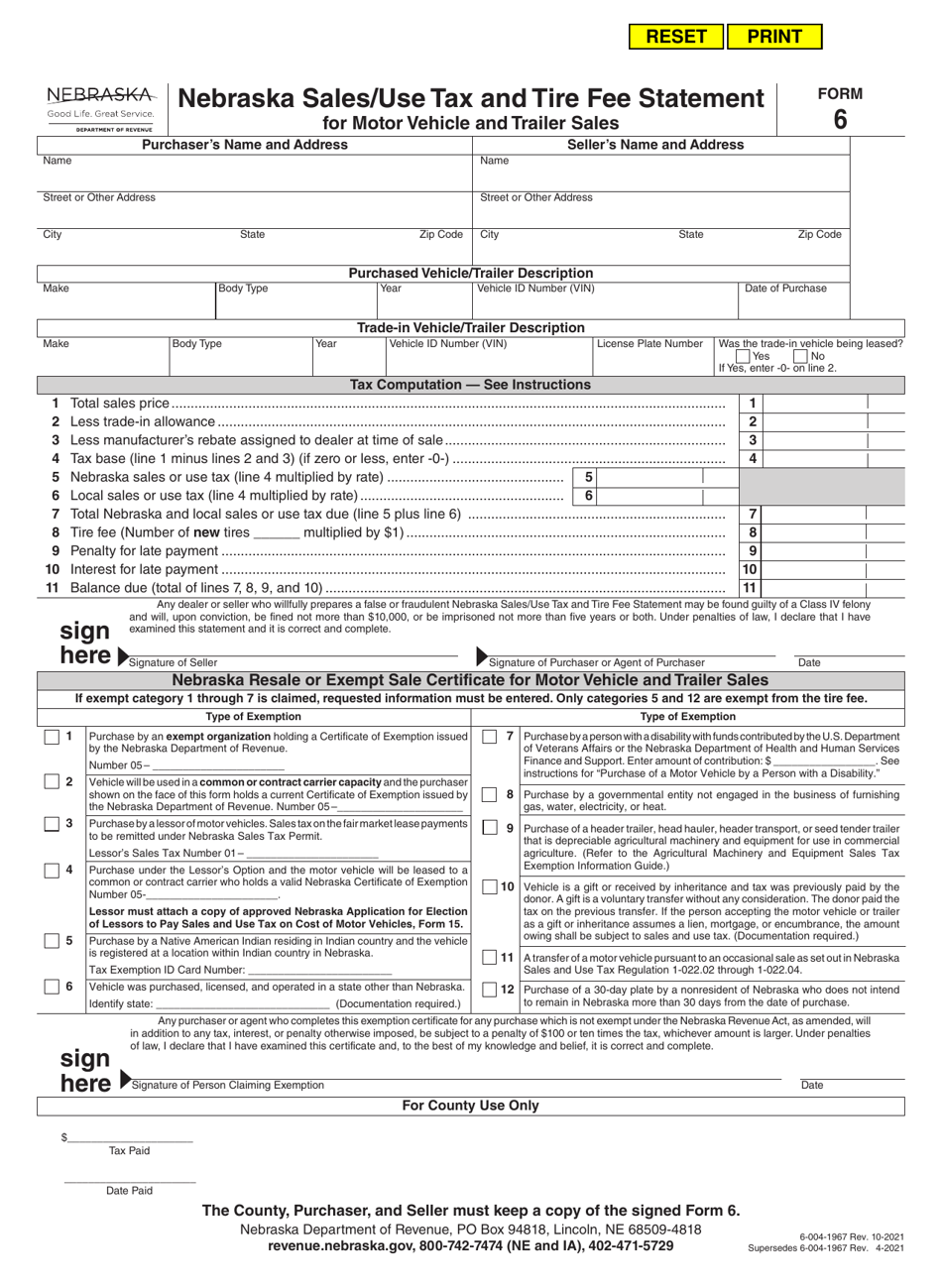

Form 6 Nebraska Fill Online Printable Fillable Blank Pdffiller

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Welcome Nebraska Department Of Motor Vehicles

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Welcome Nebraska Department Of Motor Vehicles

Vehicle Registration Nebraska Department Of Motor Vehicles

A Twenty First Century Tax Code For Nebraska Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Historical Nebraska Tax Policy Information Ballotpedia

Free Nebraska Bill Of Sale Forms 5 Pdf